unemployment tax credit update

We will begin paying ANCHOR. March 14 2021 703 PM.

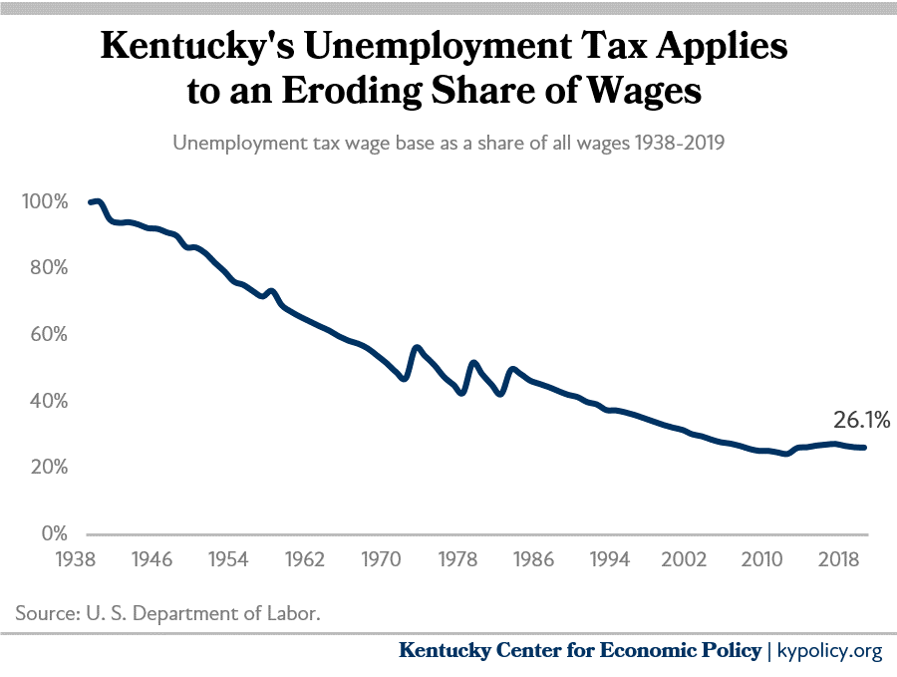

Hb 413 Provides Poorly Targeted Tax Break That Will Add Costs Later And Stress Unemployment System Kentucky Center For Economic Policy

The American Rescue Plan which President Joe Biden signed in mid-March waived federal tax on up to 10200 of unemployment benefits per person.

. The American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of. The tax exemption for 10200 in unemployment benefits currently only applies to unemployment income you collected in 2020 even though the bill also extended weekly 300. The deadline for filing your ANCHOR benefit application is December 30 2022.

The update did in fact go through and there was a change to my tax. As states end 300 weekly benefit a tax credit could step in for some For some parents advance payments for the 2021 child tax credit in the form of. Taxpayers eligible for the up to 10200 exclusion who have already filed 2020 taxes claiming their unemployment insurance benefits.

UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT You can receive your unemployment benefits two ways. Get in Touch. Property Tax Relief Programs.

He had 3754 in Unemployment and his wife had 34000. You can also request a refund of the credit. A slow update creates a delay in Covid relief payments.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of. Any credits on your account will be automatically carried forward and applied to any future amount due for 2nd quarter 2022. Fort Lee NJ 07024 201 308-9520.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. On April 6 2021 the Department of Taxation issued the tax alert Ohio Income Tax Update.

I am however preparing another return for a friend. The refunds will happen in two waves. Changes in how Unemployment Benefits are taxed for Tax Year 2020.

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

10 200 Unemployment Tax Break Refunds Will Start In May Irs Says Al Com

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Q A The 10 200 Unemployment Tax Break Williams Cpa Associates

Total Covid Relief 60 000 In Benefits To Many Unemployed Families

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Is Unemployment Taxed H R Block

Here S How The 10 200 Unemployment Tax Break Works

Anyone Have A June 14 2021 Update Does Anyone Know And Estimate Of How Much I Will Get Back From Unemployment Tax Refund R Irs

Turbotax H R Block Update Software For 10 200 Unemployment Tax Break

Unemployment Are Benefits Taxed Income Fingerlakes1 Com

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Nc Issuing Unemployment Tax Credit For 1st Quarter 2020

H R Block Turbotax Help Filers Claim 10 200 Unemployment Tax Break

Q A The 10 200 Unemployment Tax Break Wessel Company

Unemployment Tax Break Update Irs Issuing Refunds This Week Ksdk Com